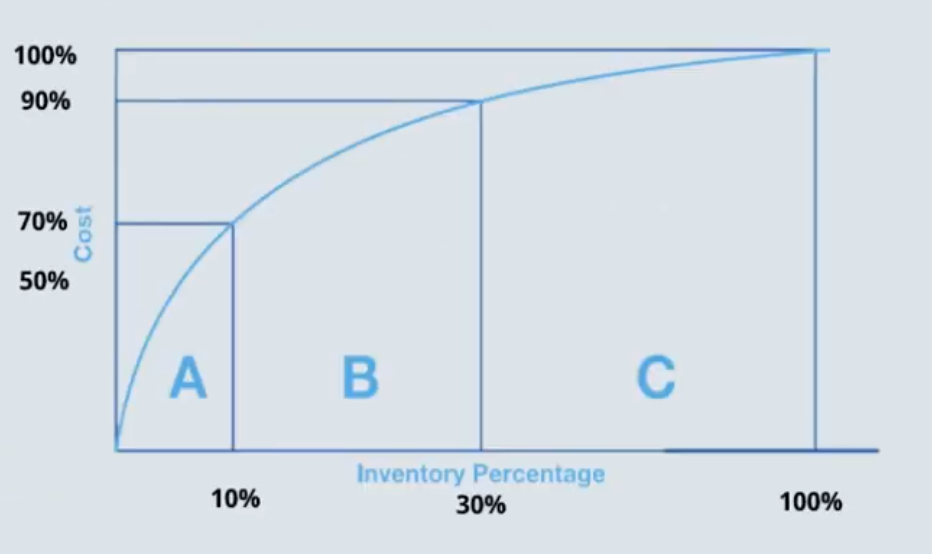

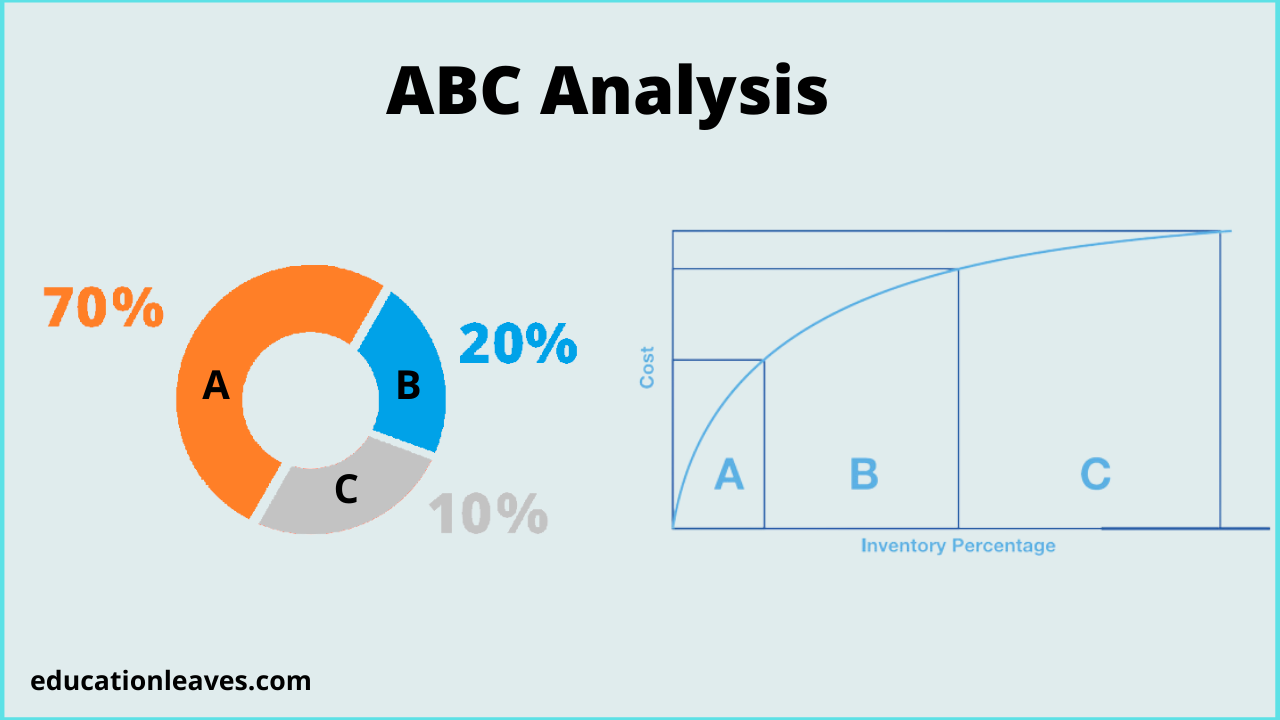

ABC analysis is an inventory management approach that controls the value of inventory items based on their usefulness to the business. ABC usually ranks items on demand, price, and risk data, and inventory managers group items into classes based on those principles so that business leaders can understand which products or services are most crucial to the financial profit of their business.

The ABC analysis shows that inventories of an industry are not of equal value. So, the inventories are grouped into three categories according to their importance and value. The three groups are A, B, and C.

‘A’ Items are very crucial for an organization because of their high value and demand. ‘B’ items are important but are comparatively less important than ‘A’ items and more important than ‘C’ items. ‘C’ items are not so important and are valuable to an organization.

What you are going to learn?

Pareto Principle and ABC Analysis:

The Pareto principle claims that – Most results come from only 20% of efforts. Based on this principle, ABC analysis identifies that 20% of goods deliver about 80% of the value of a business. So, most companies have a few ‘A’ items, a slightly more number of ‘B’ items, and a huge number of ‘C’ Items.

The Pareto principle is not always completely accurate, but analysis shows that valuable things bend toward an 80/20 distribution. ABC analysis finds the sweet spot (where most of a business’s revenue comes from with less effort) of a business.

Example of ABC Analysis

Samsung Galaxy Smartphones:

| Type | Importance | Percentage of total inventory | Annual Consumption Value | Controls | Percentage of total inventory |

| Class A (S series) | Higher dollar value | 15%-20% | 60% – 70% | Tight | High |

| Class B (A series) | Medium dollar value | 30% | 30% – 35% | Medium | Good |

| Class C (M, F series) | Low dollar value | 50% | 10% – 15% | Basic | Minimal |

How to Calculate ABC Analysis:

Here is a formula by which we can calculate ABC inventory analysis;

(Annual number of items sold) x (Cost per item) = (Annual usage value per product)

Benefits of ABC Analysis:

There is a long list of benefits of ABC analysis. Let’s discuss some of them;

1. Increased Inventory Forecasting:

The analysis specifies the products that are in need. A business can then use its warehouse to sufficiently stock those products and maintain lower stock levels for Class B or C items.

2. Better Inventory Forecasting:

Collecting data and monitoring customer demand increase the accuracy of sales forecasting. Inventory managers can utilize these data to set production levels and prices to increase overall profit for the organization.

3. Better Resource Allocation:

This is the way to continuously evaluate resource allocation to ensure that class ‘A’ items align with customer demand. When demand becomes lower, recreate the items to make better and a new class ‘A’ product.

4. Better Pricing:

A hike in sales for specific items indicates demand is increasing and the increase in price is reasonable. It increases the profitability of a company.

5. Improved Customer Service:

Service depends on some factors like- item cost, profit earned from that item, quantity sold, etc. If you consider the most profitable items, you’ll get better customer service from the company.

6. Control over High-Cost Items:

Class A inventory is closely linked to a company’s profit. Prioritize, track demand, and sustain healthy stock levels, so there are always sufficient essential products on hand.

7. Reduced Storage Expenses:

By carrying the correct ratio of stock based on the A, B, and C classes, you can cut down the inventory carrying costs that come with keeping excess inventory.

Disadvantages or Drawbacks of ABC Analysis:

Despite many advantages, there are some major disadvantages to the ABC analysis process. Here are some of them:

1. It Ignores GAAP:

ABC analysis does not follow the principles of Generally Accepted Accounting Principles (GAAP). So, it is suitable for only internal use.

2. Time Consuming:

This is a very complex method while categorizing materials into different groups. For this, it consumes more time, and labor in the case of a large group of inventory.

3. Static Nature:

Sometimes, the value of the material depends on the market trends. With the change in dollar value in the market, category ‘A’ products may shift to Category ‘B’, and Category ‘C’ products may shift to category ‘A’. In this type of situation, ABC analysis becomes unreasonable because of a lack of dynamism.

4. Not Suitable for Small Business:

The businesses that don’t have a large variety of products, or small businesses don’t require ABC analysis for their business. It is also not suitable for materials that cannot be standardized.

5. Possibility of Loss:

ABC analysis is mainly focused on making the most profit from Category ‘A’, and Category ‘B’ products. This motive can push you to a huge financial loss if your top category inventories are unable to create an impact in the market.

How to Implement ABC Analysis:

Implementing ABC analysis consists of 6 steps. First, determine the objectives you are trying to reach. Once you determined your objectives, then you should collect the required information according to your target. Then you have to categorize the inventories into three groups according to your collected data. Then track the result and make decisions about future inventories.

1. Identify the Objective:

The Abc analysis can accomplish one primary goal: to enhance cash flow by having the right items available for production or to reduce procurement costs.

2. Collect Data:

The most important data to be collected is the annual spending on each item. This data should be in raw purchase dollars. Identify which items have the highest cost and which items have the lowest cost. Then gather data on how products are selling, how quickly they are stocking out, and data on inventory turnover ratio.

3. Calculate Sales Impact:

Calculate the increasing impact of the list of inventory items by dividing the item’s annual cost by total inventory annual spend and then adding that amount to the increasing total percentage spent.

Formula to calculate sales impact:

%impact = [annual item cost] / [accumulated total of all items spent] x 100

4. Sort Items into classes (A, B, or C):

Sort inventory items by decreasing order of impact (highest to lowest impact) using ABC analysis. Sort the items into groups A, B, and C. ‘A’ items are the top-preference items with the highest consumption price, ‘B’ items are significant but have a lower consumption price, and ‘C’ items are the lowest preference products.

5. Analyze:

After categorizing the products, determine the space, cost, and sales for every item. Analyze which products you would spend more on, and which would receive less. ABC calculation shows which products generate high revenue, and you should base how much time you spend focusing on those products on what percentage of revenue they are generating.

![ABC Analysis: Example, Benefit, Drawbacks, Implementation, [PDF inside]](https://educationleaves.com/wp-content/uploads/2022/07/Capture2-1.png)

Objectives of ABC Analysis

The major objectives of ABC analysis are the following:

- Efficient material management.

- Reduction in inventory cost.

- Higher inventory turnover.

- Proper maintenance of production flow.

- Optimization of acquisition and possession.

- Cordial relationship with suppliers.

- Better materials planning, forecasts, ordering, and review.

- Deal with a huge number of items.

- Focus on high profitable items.

1 thought on “ABC Analysis: Example, Benefit, Drawbacks, Implementation, [PDF inside]”