A purchase price allocation is primarily involved in accounting purposes, but it also gives a useful evaluation of the components that make up goodwill. In this process, the purchase price was allocated to all the tangible net assets, such as working capital and machinery, with the rest allocated entirely to goodwill.

What you are going to learn?

Definition

Purchase price allocation is an application of goodwill accounting whereby the acquirer company when purchasing a target company, allocates the purchase price into various assets and liabilities acquired from the transaction.

Purchase price allocation (PPA) is the process of assigning a fair value to all the assets and liabilities associated with a target company or acquired company.

Components of Purchase Price Allocation

PPA primarily consists of three components; net identifiable assets, write-up, goodwill.

Let’s discuss these components in detail:

1. Net Identifiable Assets:

Net identifiable assets refer to the total asset value of anything that belongs to the acquired company after liabilities have been deducted. These have a certain value at any particular point in time, and also have reasonably quantified benefits.

Net identified assets represent the book value of assets on the balance sheet of the acquired company. Most importantly, these include both tangible and intangible assets.

2. Write-Up:

A write-up means an increase in the book value of an asset, as its carrying value is greater than the fair market value.

A right-up takes place when a company is being acquired, and the assets and liabilities of the company are being re-assessed to fair market value under the Mergers and Acquisitions accounting process.

Write-ups also happen when the primary value of the asset is not documented accurately or when the initial write-down (Asset write-ups are the opposite of asset write-downs. Both write-down and write-up are the non-cash items.) of asset’s value is very large.

3. Goodwill:

Goodwill is an intangible asset that is correlated with the purchase of one company (target company) by another (acquiring company). In other words, goodwill is the section of the purchase price that is higher than the sum of the net fair value of all the assets purchased in the acquisition and the liabilities assumed.

Here is a formula to measure goodwill;

Goodwill= P-(F-L), where ‘P’ stand for the purchase price of the acquired company, ‘F’ stands for fair market value and ‘L’ stands for the fair market value of the liabilities of the target company.

Example of Purchase Price Allocation

M- Acquiring company

N- Acquired company/target company

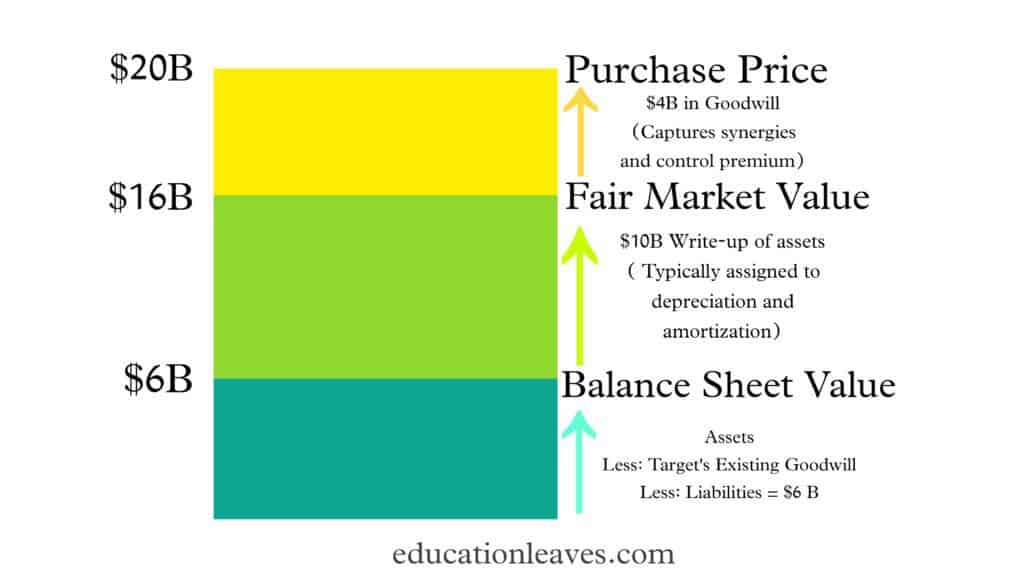

M acquired N for $20 billion. Following the finalization of the deal, M, as the acquirer, must perform purchase price allocation according to existing accounting standards.

The book value of N‘s assets is $14 billion, while the book value of the company’s liabilities is $4 billion. Therefore, the value of the net identifiable assets of N is $6 billion ($14 billion–$8 billion).

The evaluation of an independent business assessment specialist determined that the fair value of both assets and liabilities of N is $16 billion. This finding suggests that M must recognize a $10 billion write-up ($16 billion–$6 billion) to adjust the book value of the company’s assets to its fair market value.

Finally, M must record goodwill since the actual price paid for the acquisition ($20 billion) exceeds the value of the net identifiable assets and write-up ($6 billion + $10 billion = $16 billion). Thus, M must consider $4 billion ($20 billion–$16 billion) as goodwill.

1 thought on “Purchase Price Allocation (PPA): Definition, Components, Example, and PDF”