Capital budgeting is a crucial aspect of financial management for businesses and organizations of all sizes. It involves the process of planning and evaluating long-term investment projects to determine whether they are financially viable and can generate a positive return on investment.

In simpler terms, capital budgeting helps companies decide where to allocate their funds for projects that will benefit them in the long run. In this article, we will explore the fundamental concepts of capital budgeting and why it is so important for the financial health of a company.

What you are going to learn?

What is Capital Budgeting?

Capital budgeting, also known as investment appraisal, is the process of allocating funds to various projects or investments that have the potential to generate profits over an extended period, typically more than one year. These projects can include buying new equipment, expanding operations, developing new products, or even acquiring other businesses.

The main goal of capital budgeting is to determine which projects are worth pursuing and which should be rejected. Businesses have limited financial resources, and they need to make informed decisions about where to invest their money to maximize their long-term profitability.

Why is Capital Budgeting Important?

1. Efficient Resource Allocation:

Capital budgeting helps businesses allocate their limited financial resources efficiently. By carefully evaluating investment opportunities, a company can avoid wasting money on projects that may not yield a substantial return. This ensures that resources are directed towards projects with the highest potential for success.

2. Long-Term Planning:

Many investment projects have a long-term impact on a company’s financial performance. Capital budgeting allows businesses to plan for the future and make strategic decisions that will benefit them in the long run. It helps them stay competitive in their industry and adapt to changing market conditions.

3. Risk Management:

Every investment carries some level of risk. Capital budgeting involves a thorough analysis of the risks associated with each project. By identifying and assessing these risks, businesses can make informed decisions and implement risk mitigation strategies, reducing the chances of financial losses.

4. Maximizing Shareholder Value:

Shareholders invest in a company with the expectation of earning a return on their investment. Capital budgeting helps businesses make decisions that maximize shareholder value by choosing projects that generate higher returns and enhance the company’s overall financial position.

Methods of Capital Budgeting

Although there are a number of capital budgeting methods, three of the most common ones are:

- Discounted cash flow,

- Payback analysis, and

- Throughput analysis.

1. Discounted cash flow

Discounted Cash Flow (DCF) analysis is a financial valuation method used to estimate the value of an investment or business based on the present value of its expected future cash flows. This typically involves estimating cash flows for a certain number of years into the future. Cash flows may include revenue, operating expenses, taxes, and capital expenditures.

The discount rate, often called the required rate of return, represents the rate of return investors expect to earn on their investments. It is used to discount future cash flows back to their present value.

Once you have forecasted the future cash flows and determined the discount rate, you can calculate the present value of each cash flow.

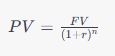

The formula to calculate the Present Value (PV) of a future cash flow is:

Where:

- PV is the Present Value of the cash flow.

- FV is the Future Value (the amount of the cash flow you’re trying to discount).

- r is the discount rate (the rate at which you want to discount the future cash flow).

- n is the number of years into the future the cash flow is expected.

Sum up all the present values of the cash flows to find the net present value of the investment.

Project managers can use the DCF model to decide which of several competing projects is likely to be more profitable and worth pursuing. Projects with the highest net present value should generally rank over others.

2. Payback analysis

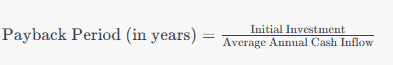

Payback analysis is the simplest form of capital budgeting analysis, but it’s also the least accurate. Payback analysis calculates how long it will take to regain the costs of an investment. The payback period is identified by dividing the initial investment in the project by the average yearly cash inflow that the project will generate.

The formula to calculate the payback period is as follows:

Where:

- “Initial Investment” is the total amount of money invested at the beginning of the project or venture.

- “Average Annual Cash Inflow” is the expected annual cash flow generated by the project.

For example, if it costs $4 million for the initial cash outlay, and the project generates $1 million per year in revenue, it will take four years to recoup the investment.

Payback analysis is usually used when companies have only a limited amount of funds to invest in a project, and therefore need to know how quickly they can get back their investment.

3. Throughput analysis

Throughput refers to the rate at which an investment generates returns or cash flows over its useful life. It helps assess the efficiency and profitability of capital expenditures. This method focuses on assessing how efficiently an investment can convert invested capital into profitable returns. Here’s a simplified process for conducting throughput analysis in capital budgeting:

Determine the initial capital outlay required for each project. This includes costs such as equipment, construction, installation, and any other relevant expenses. Estimate the expected cash flows that each project will generate over its useful life. This should include projections of revenues, operating expenses, and any incremental cash flows specific to the project.

Calculate the throughput for each investment by dividing the expected annual net cash flows, which are cash flows after operating expenses and taxes, by the initial investment cost.

Throughput = Annual Net Cash Flows / Initial Investment Cost.

Rank the projects based on their calculated throughputs. Projects with higher throughputs are generally prioritized because they are expected to generate returns more efficiently.

Capital Budgeting Process

Capital budgeting is a systematic approach used by organizations to evaluate and select long-term investment projects. These projects can encompass a wide range of activities, from acquiring assets and expanding facilities to launching new products. The process involves several key steps:

Step 1. Project Identification:

The process begins with the identification of potential investment projects. These projects can originate from various sources, such as market research, internal requirements, innovation, or strategic planning.

Step 2. Project Evaluation and Screening:

Each project is evaluated based on its alignment with the organization’s objectives and goals. Initial evaluations consider factors like market demand, competition, regulatory compliance, and strategic fit.

Step 3. Estimation of Cash Flows:

Financial analysts estimate expected cash flows for each project over its projected life. This includes both incoming cash flows (revenues, cost savings) and outgoing cash flows (initial investment, operational expenses, maintenance).

Step 4. Discount Rate Selection:

Selecting an appropriate discount rate is vital to consider the time value of money. The chosen discount rate reflects the opportunity cost of capital, which represents the return that could be earned from similar risk investments.

Step 4. Capital Budgeting Techniques:

To assess the financial viability of projects, organizations use various capital budgeting methods, including:

- Net Present Value (NPV): This method calculates the present value of cash flows and subtracts the initial investment. A positive NPV signifies a financially viable project.

- Internal Rate of Return (IRR): IRR is the discount rate at which the NPV equals zero. Projects with an IRR greater than the discount rate are usually considered attractive.

- Payback Period: This method identifies the time required for a project to recoup its initial investment. Shorter payback periods are often preferred.

- Profitability Index: The profitability index (PI) is the ratio of the present value of cash inflows to the initial investment. A PI greater than 1 suggests a favourable investment.

Step 5. Risk Assessment:

A thorough assessment of project risks is conducted, which may involve sensitivity analysis, scenario planning, and the consideration of external factors that could impact the project’s performance.

Step 6. Project Selection and Ranking:

Projects are ranked and prioritized based on financial metrics and alignment with the organization’s strategic objectives. Those with the highest NPV, IRR, or other favourable metrics are given priority.

Step 7. Decision-Making and Approval:

Management and key stakeholders review the project evaluations and recommendations. Decisions are made to either approve or reject projects, with priority given to those demonstrating strong financial metrics and strategic alignment.

Step 8. Project Implementation:

Once a project is approved, it moves to the implementation phase, where resources are allocated and the project is executed according to the approved plan.

Step 9. Post-Implementation Review:

After project completion, it is crucial to monitor its performance and compare actual results with initial estimates. This facilitates learning and process refinement for future projects.

Step 1. Continuous Monitoring:

Ongoing monitoring ensures that the project continues to meet its financial goals and remains aligned with the organization’s strategic objectives.

The capital budgeting process is indispensable for organizations, enabling them to make well-informed investment decisions that contribute to long-term financial success and strategic growth. It provides a structured framework for evaluating and selecting the most promising investment opportunities while considering associated risks and returns.

Limitations of Capital Budgeting

Capital budgeting is a crucial financial process for evaluating long-term investment opportunities, but it comes with several limitations:

- Uncertain Future: Capital budgeting relies on future cash flow predictions. The accuracy of these forecasts is inherently uncertain, making it challenging to make precise investment decisions.

- Time-Consuming: The process of evaluating potential projects is time-consuming and can delay decision-making, which might not be suitable for rapidly changing markets.

- Ignoring External Factors: It often ignores external factors like changes in economic conditions, regulatory changes, and market dynamics, which can significantly impact the success of an investment.

- Inflexibility: Once an investment is made, it’s often challenging to reverse, even if circumstances change. This can lead to sunk costs and inefficiencies.

- Ignores Non-Monetary Benefits: Capital budgeting tends to focus primarily on financial metrics, ignoring non-monetary benefits like brand value or employee satisfaction, which can be essential for a business’s long-term success.

- Ignores Risk Tolerance: It may not adequately account for a company’s risk tolerance and can lead to investments that are overly conservative or too risky.

- Doesn’t Consider Strategic Goals: It may not align with a company’s strategic goals, as it often focuses on short-term profitability rather than long-term strategic objectives.

- Overemphasis on Quantitative Data: It tends to prioritize quantitative data over qualitative factors, potentially overlooking critical aspects of an investment.

Conclusion

Capital budgeting is a fundamental process that allows businesses to make informed decisions about allocating their financial resources to long-term investment projects. By carefully evaluating the potential risks and returns of each project, companies can maximize their profitability, plan for the future, and create value for their shareholders.

In simple terms, capital budgeting helps businesses answer the crucial question: “Is this investment worth it?” By using different techniques companies can navigate the complex world of investment decisions and make choices that will benefit them in the long run.