In the complex world of economics and business, the concept of marginal cost stands as a guiding beacon for decision-makers. Marginal cost, often abbreviated as MC, is not just a term tossed around in boardrooms and lecture halls; it is a fundamental principle that drives crucial decisions on production, pricing, and profit maximization. In this article, we will delve into the heart of this concept, exploring what marginal cost means, how it is calculated, and why it is an indispensable tool for businesses of all sizes and industries.

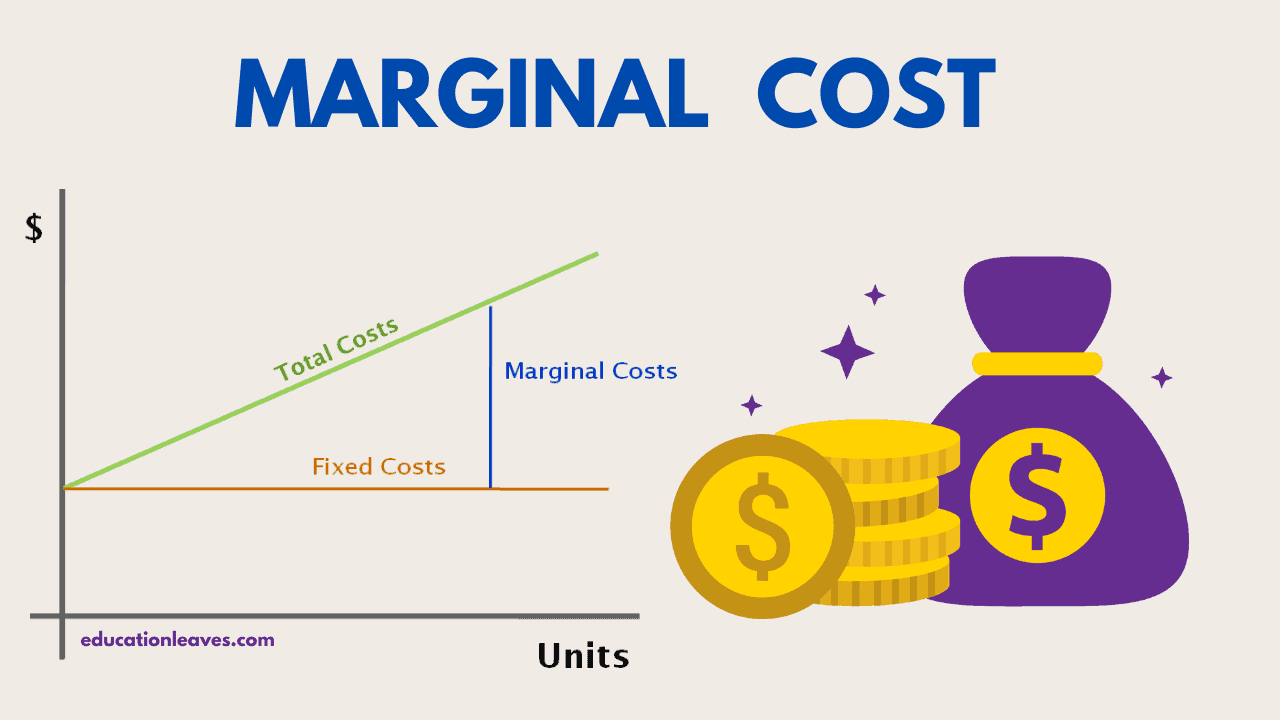

Marginal cost is the additional cost a business incurs when it produces one more unit of a good or service. In simpler terms, it represents the cost of making an extra item. It’s a fundamental concept in economics and helps companies make decisions about production levels and pricing. When a company’s marginal cost is low, it’s often a good idea to produce more, but when the marginal cost is high, making more could be expensive and less profitable.

What you are going to learn?

Formula and Example of Marginal Cost

Here are the steps to calculate marginal cost:

- Gather Data: Collect data on the total cost of production for different levels of output. This data can be obtained from production records, cost accounting systems, or other relevant sources.

- Identify Change in Output: Determine the change in output between two production levels. For instance, you might compare the total cost of producing 10 units to the total cost of producing 11 units.

- Identify Change in Cost: Calculate the change in total cost between the two production levels. This involves subtracting the total cost at the lower output level from the total cost at the higher output level.

- Divide Change in Cost by Change in Output: Divide the change in total cost by the change in output. This calculation will give you the marginal cost, which represents the incremental cost of producing one additional unit of output.

The formula for calculating marginal cost is straightforward: Marginal Cost (MC) = Change in Total Cost / Change in Quantity In mathematical terms, it’s often written as MC = ΔTC / ΔQ, where ΔTC is the change in total cost and ΔQ is the change in quantity produced.

Let’s say a bakery produces cupcakes. If the total cost of producing 100 cupcakes is $200, and the total cost of producing 101 cupcakes is $205, the marginal cost of producing the 101st cupcakes is $5. This means it costs an additional $5 to make just one more cupcake.

Significance of Marginal Cost With Proper Example

The significance of marginal cost can be best understood through straightforward explanations and practical examples, as it plays a critical role in decision-making for businesses and helps optimize their operations. Here’s a more detailed explanation with practical examples:

1. Efficient Production:

- Marginal cost tells a company how much it costs to produce one more unit of a product. When the marginal cost is low, it indicates that producing additional units is relatively inexpensive. This information is crucial for businesses to determine their production levels. For example, consider a pizza restaurant. If the marginal cost of making an extra pizza is minimal compared to the selling price, it’s profitable to increase production during busy hours to meet customer demand.

2. Pricing Strategies:

- Marginal cost is directly linked to pricing strategies. Companies can set their prices by considering both their marginal cost and the demand for their product. When the marginal cost is less than the price at which they can sell a unit, they have room to lower prices while still making a profit. For instance, an electronics manufacturer might reduce the price of a smartphone during a promotional sale, but they will ensure that the marginal cost remains lower than the sale price to maintain profitability.

3. Profit Maximization:

- To maximize profits, companies aim to produce at a level where marginal revenue (the additional revenue from selling one more unit) equals or surpasses marginal cost. Let’s say a software company develops and sells licenses for its software. By analyzing the marginal cost of producing an extra license and the revenue generated from selling it, the company can determine the optimal number of licenses to produce to maximize their profits.

4. Resource Allocation:

- Marginal cost is valuable in resource allocation decisions. Businesses often have limited resources, such as labor and materials. They can use marginal cost to decide where to allocate these resources most effectively. For example, a car manufacturer can evaluate the marginal cost of producing different car models and allocate resources to the models with the lowest marginal cost to optimize their production.

5. Identifying Economies of Scale:

- Understanding how marginal cost changes as production levels vary is essential. It helps companies identify economies of scale. In simple terms, if increasing production leads to a significant drop in marginal cost, it may indicate efficiency gains due to a larger scale of operation. For example, a clothing manufacturer may find that the marginal cost of producing 1,000 shirts is significantly lower per shirt compared to producing just 100 shirts, indicating economies of scale.

The significance of marginal cost is evident in its ability to guide businesses towards efficient production, optimal pricing, and profit maximization. By using practical examples and straightforward explanations, companies can harness the power of marginal cost to make informed decisions that lead to increased efficiency and profitability.

Applications of Marginal Cost Analysis

- Menu Pricing:

- Restaurants and other businesses that offer menu items can use marginal cost analysis to determine optimal pricing for each item. By balancing the marginal cost of each item with the expected demand and revenue generated, they can set prices that maximize profitability.

- Production Line Optimization:

- Factories and manufacturing companies can use marginal cost analysis to optimize production line configurations. By evaluating the marginal cost of each product or component, they can determine the most efficient production flow and allocation of resources.

- Sales and Promotional Strategies:

- Companies can use marginal cost analysis to inform sales and promotional strategies. By understanding the marginal cost of acquiring and retaining customers, they can tailor their marketing efforts and determine the return on investment (ROI) of various promotional campaigns.

- New Product Development:

- Marginal cost analysis plays a role in new product development decisions. Companies can assess the marginal cost of producing a new product against the potential revenue it could generate. This analysis helps determine whether the new product is viable and worth pursuing.

- Supply Chain Management:

- Marginal cost analysis can inform supply chain decisions. Companies can evaluate the marginal cost of sourcing materials from different suppliers or locations. This analysis helps identify the most cost-effective supply chain strategies.

Marginal Cost and Marginal Revenue & Relation Between Them

Marginal cost (MC) and marginal revenue (MR) are two fundamental economic concepts that play a crucial role in business decision-making, particularly in pricing and production strategies. Here’s an explanation of both terms and how they relate to each other:

1. Marginal Cost (MC):

- Marginal cost represents the additional cost a business incurs when it produces one more unit of a good or service. It measures the change in total cost that results from producing an extra unit. In simple terms, MC answers the question: “How much does it cost to make one more item?”

- MC is essential for businesses to determine the most cost-effective level of production. When the MC is lower than the price a business can charge for its product, it’s usually a good idea to produce more. But when the MC exceeds the price, producing more would lead to losses.

2. Marginal Revenue (MR):

- Marginal revenue represents the additional revenue a business earns from selling one more unit of a product. It measures the change in total revenue that results from selling an extra unit. In other words, MR answers the question: “How much more revenue will be generated by selling one more item?”

- MR is vital for businesses to assess the impact of increasing or decreasing production on their revenue. If MR is greater than MC, it suggests that producing more is profitable because each additional unit contributes more revenue than it costs to produce. If MR is less than MC, it indicates that reducing production may lead to higher profits.

Relationship between MC and MR:

- The relationship between MC and MR is essential for profit maximization. Businesses aim to produce at a quantity where MR equals or exceeds MC. When this condition is met, they are maximizing their profits. This point is known as the profit-maximizing level of production.

- If MR is greater than MC, the firm should produce more because the additional unit adds more to revenue than it costs to produce, increasing overall profit. Conversely, if MR is less than MC, reducing production will lead to higher profits because the cost saved from producing less outweighs the revenue loss.

In summary, marginal cost (MC) and marginal revenue (MR) are intertwined concepts in economics and business. They help companies determine the optimal level of production that maximizes profit. When MR is equal to or exceeds MC, businesses are in a position to make the most financially sound decisions regarding production and pricing. This balance between cost and revenue is central to achieving sustainable profitability.

Conclusion

In conclusion, the concept of marginal cost is a cornerstone of economic and business decision-making. It offers a window into the intricate interplay between production costs, pricing strategies, and profit maximization. By understanding how the cost of producing one more unit changes with varying levels of output, businesses, irrespective of their size or industry, can steer their operations towards greater efficiency and profitability.

The practical applications of marginal cost are far-reaching. It empowers companies to make informed choices about resource allocation, pricing structures, and production levels. It enables them to identify the optimal point at which marginal revenue aligns with marginal cost, paving the way for profit maximization.

Moreover, the universality of marginal cost, adaptable to industries ranging from manufacturing to services, underscores its indispensability. It is a versatile tool that transcends boundaries and empowers businesses to navigate the complexities of cost management in an ever-evolving economic landscape.

In a world where every dollar matters, where every resource allocation decision carries significance, and where the pursuit of profitability is relentless, the concept of marginal cost remains a steadfast guide. It illuminates the path to efficient production, cost control, and long-term success, making it an indispensable tool for businesses determined to thrive and prosper.

3 thoughts on “Marginal Cost: Definition, Formula, Examples, Significance, marginal Revenue, and 5 Real-World Applications”