What is Monetary Policy? [PDF Included] Tools, Challenges, & Objectives

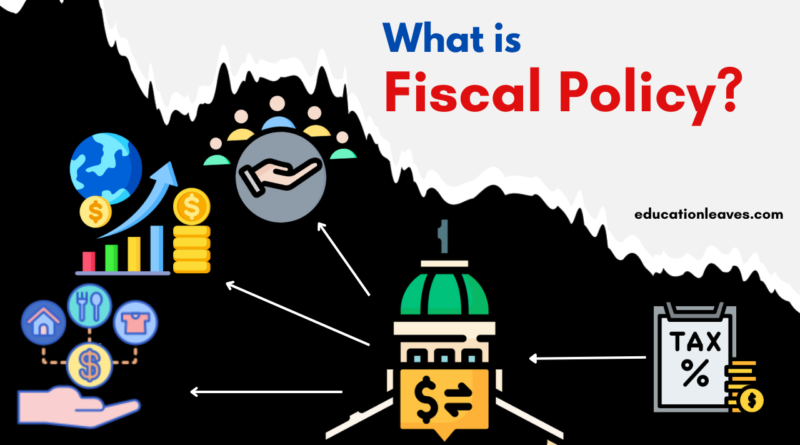

monetary policy is simply a set of tools used by a nation’s central bank to manage the money supply and achieve specific economic goals. Think of it as a conductor, wielding a baton to influence the orchestra of the economy, aiming for a harmonious balance between growth, stability, and price control.

Read More