What is Depreciation? Understand Depreciation in Simple Words. (PDF Inside)

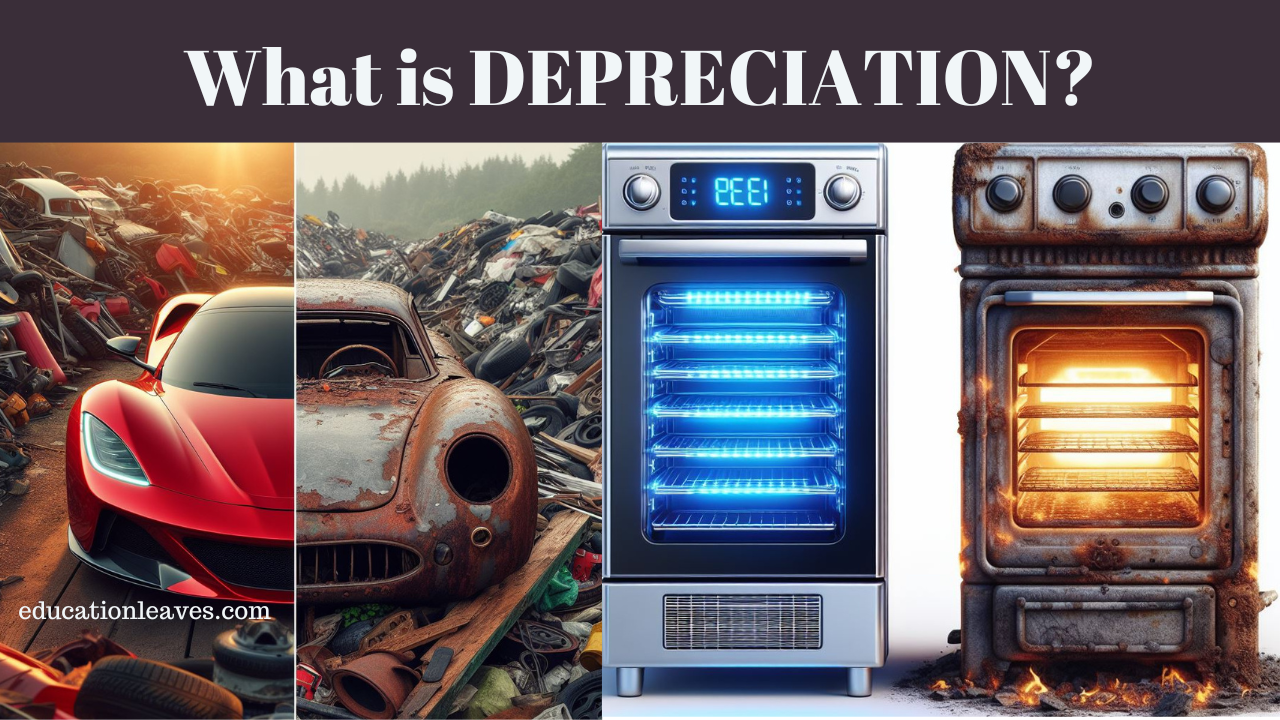

Depreciation is an accounting practice that recognizes the gradual wearing down or obsolescence of assets. Instead of considering their purchase price as a one-time expense, it spreads that cost over their estimated useful life. This allows businesses to accurately represent their financial health and profitability, reflecting the declining value of their assets and preventing misrepresentation of their real worth.