Understanding Financial Leverage & Operational Leverage and Difference Between Them

Leverage is a financial concept that refers to the ability to magnify the impact of an investment or a business decision through the use of borrowed capital. It involves using various financial instruments or borrowed funds to increase the potential return on an investment.

There are mainly two types of leverages:

What you are going to learn?

1. Financial Leverage

In the world of finance, financial leverage is like a double-edged sword – it can amplify your gains but also magnify your losses. It’s essentially the use of borrowed funds to make an investment, hoping for a return that outpaces the cost of borrowing. Think of it like using a lever to pry open a treasure chest – a small movement can yield a big result, but if you miscalculate, you could end up crushed by the weight of the lever itself.

Here’s how it works:

- You invest using borrowed money: Imagine you have $10,000 and want to buy a $50,000 investment. You could borrow the remaining $40,000 through a loan or other debt instrument. This is leverage in action.

- Potential for higher returns: If the investment increases in value by 20%, your initial $10,000 would become $12,000. But with leverage, your profit doubles! Because you borrowed $40,000, your total gain would be $24,000 (20% of $50,000). This is the magic of leverage – it magnifies your gains.

- Increased risk: But here’s the catch: if the investment loses value by 20%, your $10,000 would shrink to $8,000. But with leverage, your loss amplifies even more. Your total loss would be $16,000 (20% of $50,000). This is the double-edged nature of leverage – it can magnify your losses just as much as your gains.

Examples of financial leverage:

- Buying a house: Many people use mortgages to leverage their savings and purchase a home. They pay a portion of the price (down payment) and borrow the rest, hoping the value of the house increases over time, providing them with a profit when they sell.

- Investing in stocks: Investors can use margin accounts to borrow money to buy stocks. This allows them to control a larger portfolio with less capital, but it also increases their risk and potential losses.

- Businesses using debt: Companies often use debt financing to expand their operations and invest in new projects. This can be a valuable strategy for growth, but it also increases the company’s financial risk if the investments don’t generate enough returns to cover the debt.

Key things to remember about financial leverage:

- It’s a powerful tool, but use it with caution: Leverage can be a great way to boost your returns, but it’s crucial to understand the risks involved.

- Only borrow what you can afford to repay: Make sure you can comfortably handle the debt payments even if the investment doesn’t perform as expected.

- Do your research and invest wisely: Don’t blindly chase returns with leverage. Choose investments you understand and have confidence in.

- Diversify your portfolio: Don’t put all your eggs in one basket. Spread your investments across different asset classes to minimize risk.

Financial leverage is a complex concept, but hopefully, this explanation gives you a clear understanding of its potential benefits and pitfalls. Remember, knowledge is power – the more you understand about leverage, the better equipped you’ll be to make informed investment decisions that benefit your financial goals.

2. Operating Leverage / Operational Leverage

In the financial dance of a business, operating leverage is another captivating partner, influencing the rhythm of profits and losses in response to sales changes. Imagine it like a springboard; small shifts in sales can propel profits to great heights, but a misstep can lead to a jarring plunge. Let’s delve deeper into this intriguing concept:

The Essence of Operating Leverage:

At its core, operating leverage measures the sensitivity of a company’s operating income to changes in its sales volume. It highlights how much a company’s profits can swing based on fluctuations in sales. Companies with high operating leverage experience amplified changes in profits for even small changes in sales, while those with low operating leverage see more muted profit fluctuations.

The Anatomy of Leverage:

Here’s where the springboard analogy comes in. High operating leverage typically arises from a large proportion of fixed costs in a company’s cost structure. Think rent, salaries, and machinery – these costs stay relatively constant regardless of production levels. When sales increase, these fixed costs remain the same, leaving a larger chunk of revenue to flow directly to profits. Conversely, a decline in sales doesn’t proportionately decrease fixed costs, squeezing profits more drastically.

Measuring the Leverage Dance:

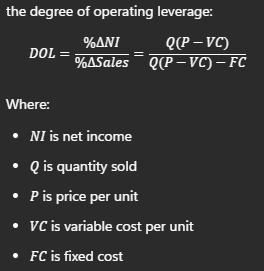

The degree of operating leverage (DOL) is a key metric to quantify this dance. It’s essentially a multiplier reflecting how much a percentage change in sales translates to a percentage change in operating income. A DOL of 2, for example, means that a 1% increase in sales would lead to a 2% increase in operating income.

Benefits and Risks of the Leverage Waltz:

High operating leverage can be a double-edged sword. On the one hand, it offers the potential for magnified profits during boom times. Imagine a software company with low manufacturing costs but high fixed development expenses. A small surge in software sales can translate into a significant jump in profits.

However, the flip side holds the risk of amplified losses during downturns. The same software company facing a dip in sales could see its profits plummet rapidly due to the burden of fixed costs.

Navigating the Leverage Landscape:

Understanding operating leverage is crucial for businesses to make informed decisions about pricing, production, and expansion. Companies with high leverage need to prioritize efficient operations and consistent sales growth to manage their fixed costs effectively. On the other hand, businesses with low leverage might have more flexibility to weather downturns but potentially miss out on explosive growth opportunities.

In conclusion, operating leverage is a powerful concept that adds another layer of complexity and excitement to the world of business. By understanding its nuances and wielding it strategically, companies can maximize their profit potential while navigating the inevitable ups and downs of the market. Remember, mastering the leverage dance requires a clear head, steady feet, and a healthy dose of caution!

Difference between Financial Leverage and Operational leverage

Certainly! Below is a detailed comparison table of Financial Leverage and Operational Leverage:

| Aspect | Financial Leverage | Operational Leverage |

|---|---|---|

| Definition | The use of borrowed funds or financial instruments to magnify potential returns. | The use of fixed costs in a company’s operations to amplify the effects of changes in sales on its earnings. |

| Type of Leverage | Involves the use of debt or other financial instruments. | Focuses on fixed costs in a company’s cost structure. |

| Risk and Return | Can amplify both returns and losses. Higher potential for profit, but increased risk. | Amplifies returns in periods of increased sales but also magnifies losses in periods of decreased sales. |

| Decision Impact | Influences the financial structure of a business. | Affects the cost structure of a business. |

| Use of Funds | Involves borrowing money to invest or expand operations. | Relies on fixed costs in production, which do not vary with the level of production. |

| Flexibility | Can be adjusted by changing the mix of debt and equity. | Relatively fixed in the short term; difficult to adjust without significant changes to the business model. |

| Calculation | Financial Leverage Ratio = (Average Assets) / (Average Equity) | Operational Leverage Ratio = (Sales – Variable Costs) / Earnings Before Interest and Taxes (EBIT) |

| Example Scenario | Borrowing money to purchase a property or finance business operations. | A manufacturing company with high fixed costs producing goods in a growing market. |

| Impact on Earnings | Influences the interest expense, potentially leading to higher earnings. | Fixed costs remain constant, contributing to higher profit margins in periods of increased sales. |

| Market Dynamics | Affected by interest rates, debt market conditions, and the cost of borrowing. | Influenced by sales volume, pricing strategy, and changes in the market demand for the company’s products or services. |

Understanding the distinctions between financial leverage and operational leverage is crucial for businesses to make informed decisions about their capital structure, risk tolerance, and overall financial strategy. While financial leverage focuses on the mix of debt and equity, operational leverage centers on the fixed costs within a company’s cost structure. Both types of leverage can impact a business’s profitability and risk profile, and a balanced approach is often necessary for sustainable and successful operations.

Related Articles:

Financial Management

Financial management is a critical aspect of running any organization, whether it’s a business, government agency, or non-profit. It involves planning, organizing, directing, and controlling the financial activities and resources of an entity to achieve its goals and objectives effectively. READ MORE>>>

Cost of Capital

The cost of capital is a fundamental concept in finance that refers to the cost a company incurs to finance its operations. It represents the overall rate of return required by investors for providing capital to the company. In essence, the cost of capital is the opportunity cost of using funds in a particular investment or business project instead of in alternative investments of similar risk. READ MORE>>>>