What is Working capital? Definition, Formula, Types

In the world of business, managing finances is crucial to success. One aspect of financial management that deserves attention is working capital. Today, we’ll explore what working capital is and why it’s important for businesses to effectively manage it.

What you are going to learn?

Definition of working capital:

“Working capital is the difference between a company’s current assets and its current liabilities. In other words, it represents the amount of money a company has available to cover its short-term obligations and expense.

Working capital is an important metric for assessing a company’s financial health, as it provides an indication of the company’s ability to meet its short-term obligations and fund its day-to-day operations. A company with positive working capital has more current assets than current liabilities, which means it has enough resources to meet its short-term obligations without having to rely on external financing.

Conversely, a company with negative working capital has more current liabilities than current assets, which means it may struggle to pay its bills and fund its operations. In this case, the company may need to borrow money or raise capital to cover its short-term obligations.

Working capital Formula

The working capital formula is applied to calculate the amount of working capital a company has available. Working capital represents the difference between a company’s current assets and its current liabilities. It shows the financial health and liquidity of a business, as it measures the company’s ability to cover its short-term obligations.

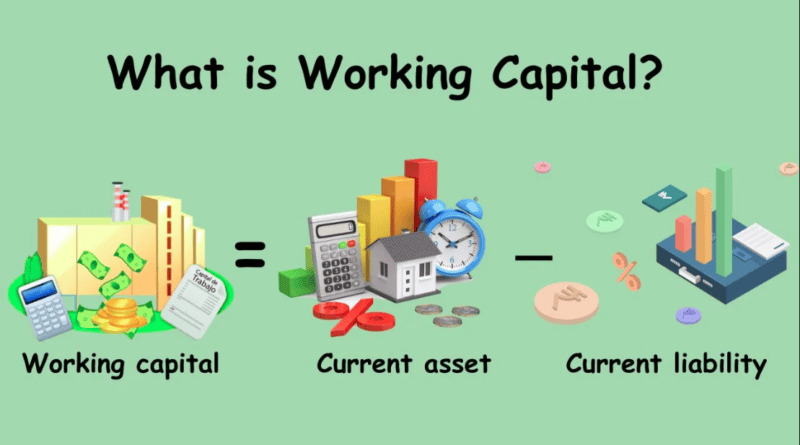

The formula for working capital is as follows:

Working Capital = Current Assets – Current Liabilities

Here’s a breakdown of the components:

- Current Assets: These are the assets that are expected to be converted into cash within one year or the operating cycle of the business, whichever is longer. Common examples include cash, accounts receivable (money owed by customers), inventory, and short-term investments.

- Current Liabilities: These are the company’s short-term obligations that are due within one year or the operating cycle. They include accounts payable (money owed to suppliers), accrued expenses, short-term debt, and other current liabilities.

By subtracting the total current liabilities from the total current assets, you can determine the working capital position of a company.

A positive working capital indicates that the company has enough current assets to cover its short-term liabilities, which is generally considered a healthy financial position. Conversely, a negative working capital implies that the company may struggle to meet its short-term obligations.

It’s important to note that the working capital figure should be interpreted in the context of the specific industry and the company’s operating cycle.

For example, say a company has $10000 of current assets and $3000 of current liabilities. The company is therefore said to have $7000 as working capital.

Elements Included in Working Capital

The current assets and liabilities used to calculate working capital typically include the following items:

Current assets:

Which can be converted into cash within one year of the balance sheet date, including:

- Cash, combining money in bank accounts and undeposited checks from customers.

- Marketable securities,

- Short-term investments a company intends to sell within one year,

- Accounts receivable,

- Prepaid expenses, such as insurance premiums,

- Advance payments on future purchases.

Current liabilities

These are all liabilities that are due within a year of the balance sheet date, including:

- Accounts payable,

- Taxes payable,

- Interest payable on loans,

- Any loan principal that must be paid within a year,

- Deferred revenue, such as advance payments from customers for goods or services not yet delivered.

Types of working capital

The types of working capital can be categorized as follows:

Gross Working Capital:

Gross working capital refers to the total current assets of a company, including cash, accounts receivable, inventory, and other short-term assets. It represents the company’s ability to meet its short-term obligations.

Net Working Capital:

Net working capital is calculated by subtracting current liabilities from current assets. It indicates the company’s liquidity position after considering its short-term obligations. Positive net working capital indicates that the company has enough current assets to cover its current liabilities.

Permanent Working Capital:

Permanent working capital represents the minimum level of investment required in current assets to support the ongoing operations of a company. It includes the funds necessary to maintain minimum levels of inventory, accounts receivable, and cash reserves to meet day-to-day operational requirements.

Temporary or Variable Working Capital:

Temporary working capital refers to the additional working capital needed to meet seasonal fluctuations, unexpected surges in demand, or other temporary requirements. It represents the difference between the peak and base levels of working capital during different business cycles.

Positive Working Capital:

Positive working capital indicates that a company has sufficient current assets to cover its short-term obligations. It is a favourable position, as it reflects the company’s ability to manage its day-to-day operations and meet its financial obligations.

Negative Working Capital:

Negative working capital occurs when a company’s current liabilities exceed its current assets. This situation is generally considered unfavourable, as it suggests that the company may face difficulty in meeting its short-term obligations.

In conclusion, working capital is a vital aspect of financial management that businesses must prioritize. By effectively managing working capital, companies can ensure smooth operations, seize growth opportunities, and enhance their financial health.