How much financing will your farm business need this year? When will the money be required and from where will it come? A little planning can help avoid short-term shortages of cash. One useful tool for organizing the use of capital in the farm industry is cash flow budgeting.

There are some reasons cash flow budget is a useful management tool:

- It forces the planning function of management.

- It provides a system of communicating the amount and timing of acquiring and investment needs with the lender.

- It tests your farming strategies, such as if you will generate enough income to meet all your cash needs.

- It provides a guideline against which you can compare your actual cash flows.

- Cash flow is a survival strategy during the times of low profitability.

What you are going to learn?

Definition of Cash flow Budgeting

A cash flow budget is a projection of all cash receipts and all cash expenditures that are expected to appear during a certain time period. Estimates can be done monthly, bimonthly, or quarterly, and can include non-farm revenue and expenditures and farm items.

What Makes Up a Cash Flow Budget

A cash flow budget is comprising cash coming in (+) or leaving (-) the business.

Net cash flow =

| Cash Coming (+) | Cash Leaving (+) |

| Cash inflow operations | Cash outflow from any operations |

| Capital asset sales | Capital asset purchases |

| Non-farm sources of income | Non-farm outflows of cash |

| New Borrowings | Debt services |

Uses Of Cash Flow

Cash flow budgeting has many uses in both performing financial analysis and operating business. It is one of the most significant matrics in all of accounting and finance.

The followings are the most common cash matrics and uses of cash flow:

- Liquidity: evaluating how well a company can reach its short-term financial obligations.

- Internal Rate of Return: Measuring the Internal Rate of return an investor gains for making an investment.

- Cash flow Yield: measuring how much cash a business makes per share, relative to its share value, expressed as a percentage.

- Cash Flow Per Share: cash from operating activities separated by the number of shares outstanding.

- P/CF Ratio: The price of a stock divided by the Cash Flow Per Share, frequently used as an alternative to the Price-Earnings or P/E ratio.

- Cash Changeover Ratio: the time between when a business pays for its inventory (cost of goods sold) and receives payment from its customers is the cash changeover ratio.

- Dividend Payments: Cash Flow can be used to fund dividend payments to investors.

- Capital Expenditures: Cash Flow can also be effective in funding reinvestment and growth in business.

Steps Involved in Constructing a Cash Flow Budget

- Build up a complete farm plan.

- Take Inventory of livestock. If an ongoing financial statement is available, information found under the current assets section can be applied.

- Estimate feed needs for the proposed livestock program. Once your feed supply and feed demands are estimated, fix the livestock program to fit them.

- First measure livestock sales, based on both production and marketing plans. Then Prepare cash receipts from livestock.

- Estimate sales of non-feed crops and excess feed. After the primary cash flow budget is done, revise your marketing plans to meet capital needs throughout the year.

- Estimate cash revenue from other sources including; USDA farm payments, custom machine work income, rental property, and other business activities.

- Estimate cash farm operating budgets. Expenses that are controlled by contract, agreement, or law can be determined directly from contract terms unless rates are required to change. Expenses should be aligned throughout the year based on your best judgment.

- Assess personal and non-farm cash expenditures that include property taxes, liabilities, insurance, rental, constructions, etc.

- Predict purchases and sales of capital assets such as machinery, equipment, land, or additional breeding livestock.

- Identify and note the scheduled principal, and interest payments on existing debts. Much of this information can be picked up from your most recent net worth report. Include only those debts that you have already gained at the starting of the budgeting period. Measure the interest that will be due at the time the payment will be made.

- Sum total cash inflows and outflows. If the expected net cash flows for the entire year and for each session are all positive, you have a workable cash flow plan. If the net cash flows for some sessions are negative, some modifications may need to be made.

How to Increase Cash Flow?

Increase Cash Flows from Operations:

One technique to increase the cash flow is speeding up normal operational sales. Areas to consider including production, price, and new or more enterprise actions. Selling market inventory if it is available and increasing custom work are the two ways to increase cash flow.

A more impressive technique is generating greater revenues from the primary source of income. Revenue is actually production multiplied by price. Thus, an increase in production or price increase cash inflows. In order for net cash flow to be better, boosting production or increasing price must be relatively better than any associated costs.

Benchmarking your operation may be a way to determine if there is potential for greater production efficiency. Feed losses, conception rates, death loss, timeliness of planting, variable rate applications, and many other elements might be a means for improving production efficiency.

Marketing may be a tactic of securing a better price, but marketing is more valuable at securing a known price ahead of time versus a “higher” known price ahead of time.

Increase Cash-Inflows From Non-Operational Sources:

Many farm families generate revenue from non-farm sources. Off-farm services are the major source of potential cash flow for the farm business and one that is often not subject to the ebbs and flows of product prices and may come with other aids such as health care and retirement.

Other potential sources of non-farm cash including contributed capital from family or non-family investors, agritourism, fish hunting, horse boarding, boat storage, and some other farming assets such as repair shop, record-keeping, seed sales, etc.

Decrease Cash Outflows from operations and Non-Operations:

Decreasing variable costs per unit of production are increasing cash flow by reducing cash outflows. This may be performed by negotiating lower lease payments, lower labor costs, or greater labor productivity, using cheaper feed ingredients, bulk buying of inputs, shared fieldwork, early detection health protocols, and collaboration.

There are some non-operational expanses should be decreased. That includes- entertainment, frequent vacations, extra luxuries, unnecessary purchasing etc.

Increasing Cash Inflow Through New Borrowing:

When other avenues have been used up, the best tool in the box is new borrowing to cover negative cash flow. In some situations, this is a natural part of the business. It is also quite normal to increase term debt for capital assets. For example, a twenty-five-year term loan for land, fifteen-year for a new building, or a three-year for a piece of machinery.

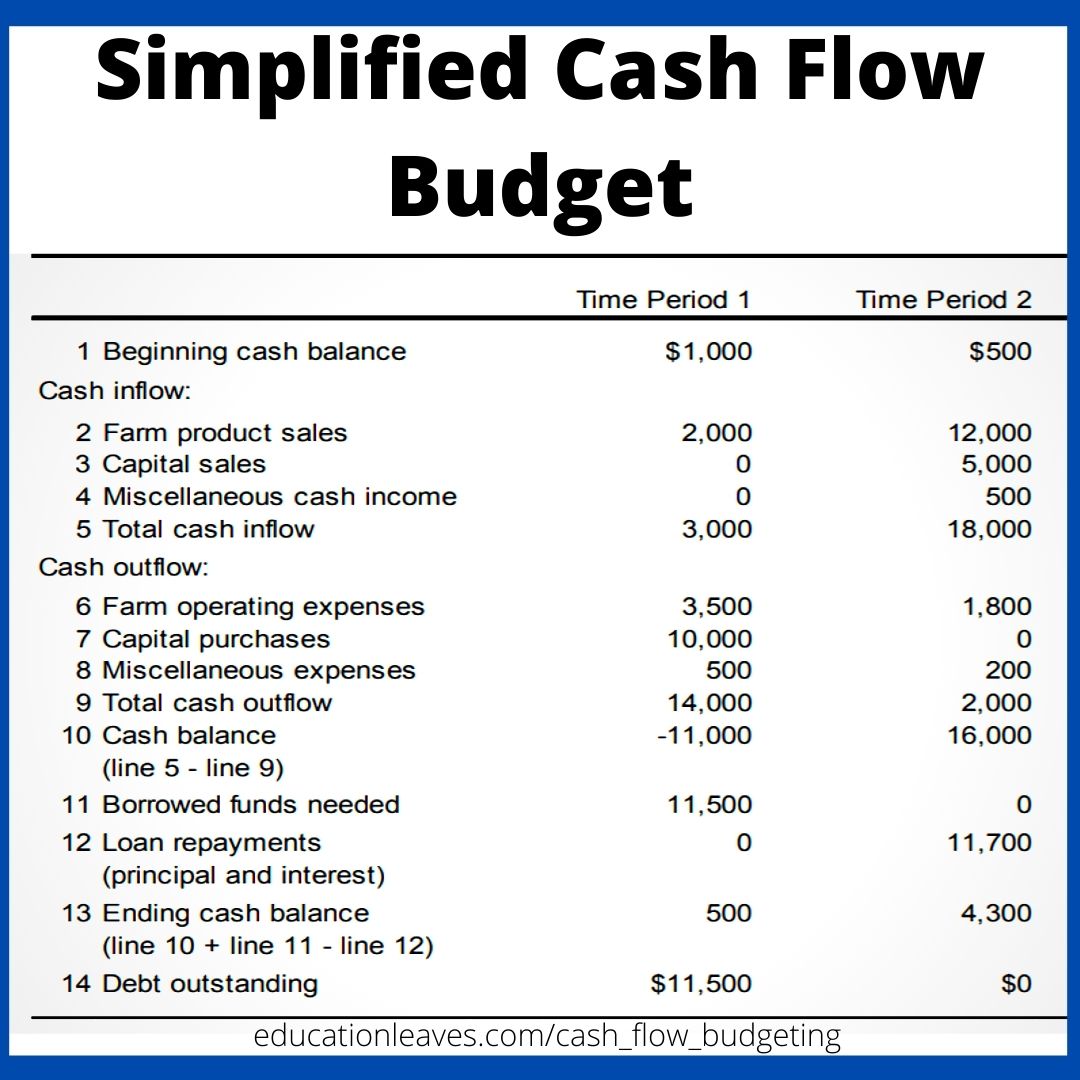

Simplified Cash Flow Budget

1 thought on “What is Cash Flow Budgeting? A Comprehensive Review (PDF)”